Modern organizations are facing infinite challenges that demand their attention and action day after day. The laundry list of concerns includes accelerating digital transformation, fast-evolving cyber risks, pandemics and extreme weather events, privacy regulations, expanding compliance requirements, and much more. Amid these concerns, one common thread ties them all together: the need for effective risk management.

In addition to the plethora of risk-related topics, businesses are also witnessing an unprecedented acceleration in the rate of transformation. This transformation is not just a matter of choice; it’s a survival strategy in an intensely competitive and rapidly changing world. However, this rapid pace of change often leads to a lack of clarity when it comes to risk ownership and management. Even when there’s awareness of the risks, they may be isolated within different parts of the organization.

The Consequences of Inadequate Risk Management

The consequences of inadequate risk management are far-reaching, affecting every aspect of the organization:

01.

Manual and Redundant Processes

Without a centralized approach to risk management, manual and redundant processes can quickly become the norm. This results in wasted time and resources.

02.

Poor or Delayed Visibility

Siloed risk information makes it difficult to get a comprehensive and real-time view of the organization’s risk profile, which can lead to delayed response times.

03.

Higher Costs

Inefficient risk management processes often result in higher operational costs and wasted resources.

04.

Poor Decisions

Incomplete or fragmented risk information can lead to poor decision-making, as key data may be missed or overlooked.

05.

Inadequate Controls

Without a clear understanding of risk ownership, organizations struggle to implement and enforce effective controls.

06.

Difficulty Providing Assurance

Stakeholders, including customers and regulators, demand assurance that risks are being managed effectively. A fragmented approach makes it challenging to provide this assurance.

07.

Poor Stakeholder Engagement

Stakeholders, including employees and external partners, may become disengaged when they perceive that their safety and security are not priorities.

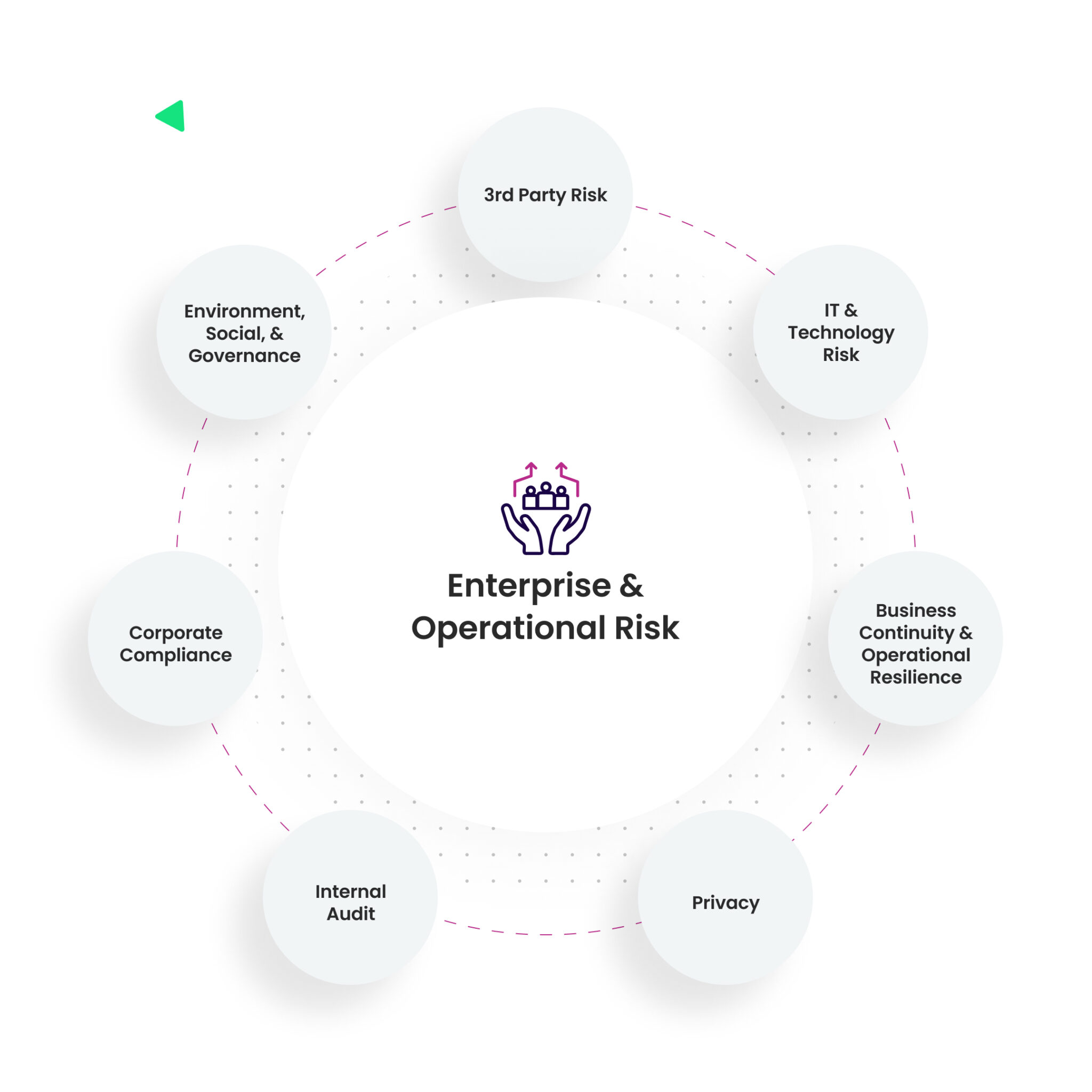

Integrated Risk Management—A Better Way to Manage Risk

In a world where uncertainty is the only certainty, organizations of all sizes and industries are constantly seeking ways to manage and mitigate risks effectively. Integrated Risk Management (IRM) is a comprehensive and strategic approach to managing risks and resilience across an organization. It involves embedding risk management and resilience principles into daily operations, decision-making processes, and the entire enterprise’s culture. The key idea behind IRM is to create a unified, holistic view of risks that is supported by data, enabling better decision-making and risk prioritization.

The Benefits of Embracing IRM

01.

Holistic Risk Perspective

IRM enables organizations to see the bigger picture. By integrating various risk management functions and data sources, it provides a unified view of risks, allowing better understanding and informed decision-making.

02.

Culture of Risk Awareness

IRM fosters a culture of risk awareness that permeates the entire organization. It encourages collaboration, communication, and accountability among different functions and stakeholders, making everyone a participant in risk management.

03.

Agility and Adaptability

In an ever-changing business landscape, organizations must be agile and adaptive. IRM supports these principles by allowing organizations to respond promptly to emerging risks and market shifts.

04.

Efficiency and Cost Reduction

By streamlining risk assessment and remediation processes, IRM reduces operational costs and enhances efficiency. It ensures that resources are optimally allocated to manage risks effectively.

05.

Alignment with Business Strategy

IRM aligns risk management activities with the broader business strategy. This alignment increases the likelihood of successful outcomes, as risk considerations are embedded in strategic decision-making.

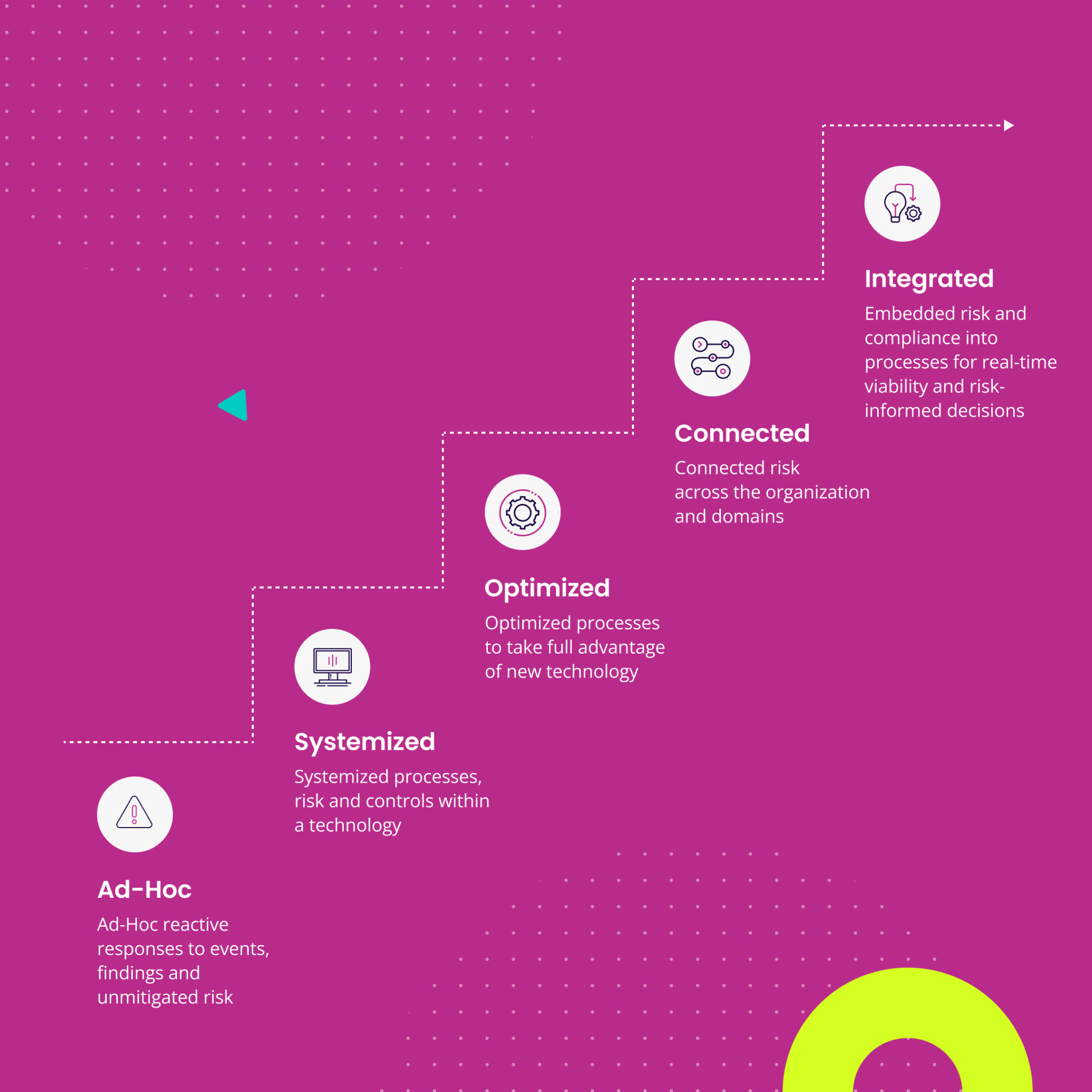

How to Implement IRM Effectively—Ten Key Steps

Integrated Risk Management is a journey that demands a proactive, collaborative, and technology-enabled approach. By following these key recommendations, your organization can establish a strong foundation for success, fostering a culture of risk-awareness, breaking down silos, and ensuring the alignment of risk management activities with business strategy.

01.

Inclusive Conversation

The first step in your IRM journey is to bring all lines of defense into the conversation. This includes not only risk management professionals but also the first and second lines of defense, such as operational teams and audit functions. Encourage open dialogue and collaboration to establish a shared understanding of risk.

02.

Executive Sponsorship

To ensure that IRM is a top organizational priority, it’s essential to obtain sponsorship at the highest executive level possible. Leadership buy-in provides the necessary resources, authority, and visibility for your IRM program.

03.

Governance Protocols

The establishment of governance protocols is vital to guide and provide oversight of the IRM process. These protocols should define roles and responsibilities, set clear expectations, and establish accountability throughout the organization.

04.

Common Risk & Control Taxonomy

A common risk and control taxonomy acts as the foundation of your IRM program. It standardizes the definitions of risks and controls across the organization, ensuring that everyone speaks the same language when it comes to risk management.

05.

Technology-Enabled Platform

Implementing an IRM program is significantly enhanced by leveraging a technology platform that allows a common database accessible by all lines of defense. Such a platform, like ServiceNow IRM, provides a single source of truth for risk and control definitions, breaking down operational silos.

06.

Documentation and Control Evidence

An effective IRM platform facilitates the documentation of processes and the collection of control evidence, making it easier to monitor and assess the effectiveness of controls.

07.

Monitoring and Testing

IRM technology enables management to monitor controls and provides the means for audit teams to conduct controls testing efficiently. This ensures that controls are not just documented but also effective in practice.

08.

Issue Management

The platform streamlines issue management, allowing organizations to identify and address risk-related issues promptly, preventing them from escalating into more significant problems.

09.

Dashboards for Visibility

IRM platforms offer customizable dashboards for executive reporting and visibility. This allows leaders to have a real-time view of the organization’s risk landscape and make informed decisions.

10.

Continuous Improvement

Finally, remember that the journey doesn’t end with implementation. It’s an ongoing process of continuous improvement. Regularly review and adapt your IRM program to evolving risks and business needs. With Veracity and RGP, we deliver the best people, technology, and processes to help build scalable, and continuous operational resilience.

Need Help Assessing Your Current Approach to Risk Management? Let’s Connect.

By embedding risk management and resilience principles into daily work, and leveraging a common platform to manage risk effectively, organizations can achieve better decision-making, foster a risk-aware culture, and increase their agility and efficiency.

Together with RGP, we offer the expertise and technology solutions to guide your organization along this ServiceNow IRM journey—helping you formulate one source of truth for clear and effective risk management for a more secure, successful future for your organization.